CorpCount offers strategic and efficient taxation services in Singapore.

The services offered by us are

- Accounts and ledger maintainence

- Cash flows and budgeting

- Bank reconcillations

- Statutory accounting

- Preparing financial statements

- Filing of accounting reports in XBRL format

- Preparation and filing of tax returns

- Compiling Director’s report

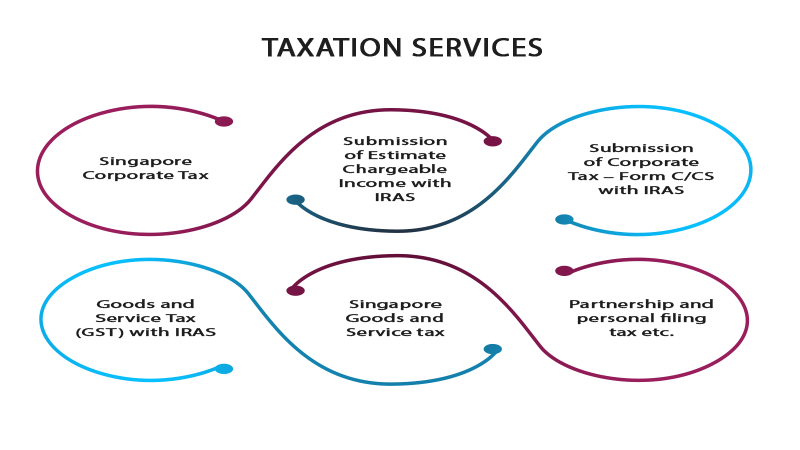

CorpCount offers a wide range of Taxation services for your company

- Singapore corporate tax

- Submission of Estimate Chargeable Income with IRAS

- Submission of Corporate Tax – Form C/CS with IRAS

- Goods and Service Tax (GST) with IRAS

- Singapore Goods and Service tax

- Partnership and personal filing tax etc.

Simplify your operations with Taxation Services

CORPORATE TAX SERVICES

Our corporate tax professionals can provide you with the relevant advice you need to make sure your business is fully tax compliant

INTERNATIONAL TAX SOLUTIONS

Our expert international tax advisors can guide you through cross-border tax structuring, risk mitigation and long-term tax planning.

PERSONAL TAX SERVICE

Our personal tax service in Singapore can assist your company and its talent in managing any personal tax issues that arise taxation advice.

GOODS AND SERVICES TAX (GST)

Our team of experienced GST specialists can help you stay up to date with changes and avoid the risk of incurring costly penalties.